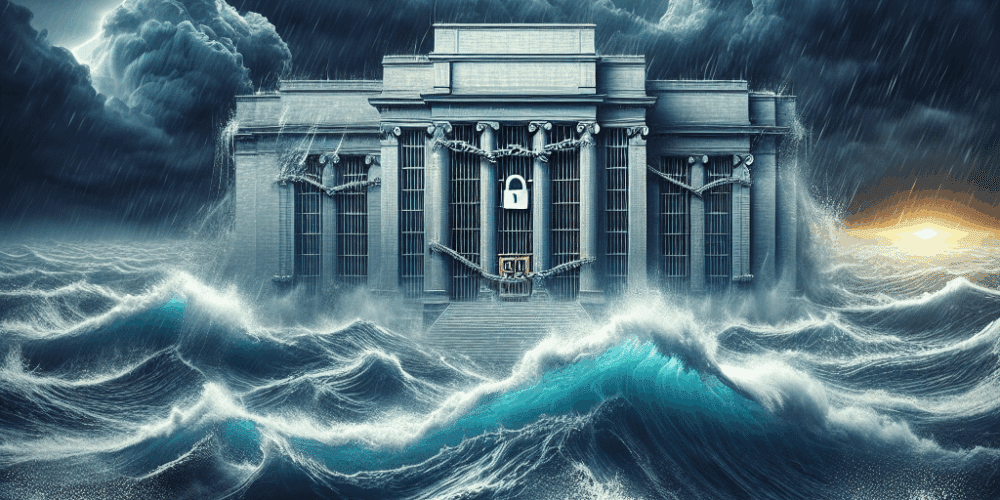

In a shocking turn of events that sent ripples through the cryptocurrency world, one of the industry’s major exchanges, CryptoGlobal, abruptly halted all crypto withdrawals late last night, citing “system upgrades and security review” as the primary reasons. This sudden development has sparked widespread concern among investors and triggered a noticeable dip in cryptocurrency market values.

CryptoGlobal, known for its robust platform that supports a myriad of cryptocurrencies, including Bitcoin, Ethereum, and Ripple, announced the halt via a brief blog post and several social media updates. The pause in withdrawals comes at a critical time when the crypto market is already facing volatility spurred by various global economic factors. The company assured its users that the measures were preventive and aimed at enhancing the platform’s security features in response to recent, unspecified cyber threats.

Further exacerbating the situation, the lack of detailed communication from CryptoGlobal has led to speculation and uncertainty, with many investors worrying about the safety of their assets. The immediate market reaction saw Bitcoin’s price drop by 3.5%, while Ethereum slid by 5.2%. Smaller altcoins were hit even harder, with some recording losses of up to 10% within 24 hours of the announcement.

Market analysts have been quick to weigh in on the situation. According to financial expert, Dr. James Harrington, “The sudden halt of withdrawals on a major exchange not only undermines investor confidence but also casts a shadow on the cryptocurrency ecosystem’s stability.” Dr. Harrington emphasized that transparency and constant communication are crucial during such critical periods to maintain trust among users.

Amidst the unfolding scenario, CryptoGlobal’s CEO, Maria Lopez, issued a statement this morning in an attempt to quell the growing anxiety among the platform’s users. “We understand the concerns raised by our valued community. Please be assured our teams are working tirelessly to upgrade our systems and enhance our security protocols. We anticipate resuming normal operations within 72 hours,” Lopez said.

The announcement has become a hot topic on various social media platforms and cryptocurrency forums, where users have been voicing their frustrations and concerns. Many are calling for more stringent regulations in the crypto industry, highlighting the need for greater accountability and operational transparency from exchanges.

This incident also underscores the ever-present risks associated with digital currency investments, including technical glitches and cyber threats, which can lead to unexpected financial losses. As digital currencies continue to gain mainstream acceptance, such incidents bring to light the pressing need for improved regulatory frameworks to safeguard investor interests.

In light of recent events, some market participants are advising caution. Veteran trader and crypto advisor, Lisa Grant, offered her perspective, suggesting that “Investors should diversify their holdings and not rely on a single exchange for transactions. It’s also wise to periodically review and secure one’s digital wallets.”

The CryptoGlobal situation remains fluid, and further updates are expected as the company progresses with its system overhaul. Meanwhile, the broader impact of this halt on the global cryptocurrency market continues to unfold, with many eyes keenly watching how other exchanges and financial institutions respond to this development.

For investors and users of CryptoGlobal, the next few days are crucial as they navigate through the uncertainties and hope for a swift resolution to the ongoing issues. As the situation develops, it serves as a stark reminder of the complexities and inherent risks of the digital currency world.

Conclusion

This incident is a pivotal moment for the crypto industry, potentially catalyzing calls for more rigorous security measures and regulations. As the market stabilizes, the responses from global exchanges and regulatory bodies will likely shape the future operational protocols and trust dynamics within the crypto sphere.