In a dramatic turn of events that has caught both seasoned investors and market novices off guard, Bitcoin has shattered previous price records, reaching a new all-time high. This recent surge is closely tied to the increasing involvement of institutional investors who are now viewing cryptocurrencies as a viable component of their investment portfolios.

For years, Bitcoin and its peer cryptocurrencies have been viewed with a mix of skepticism and intrigue. However, the tide has significantly turned over the last few months, with major financial institutions and publicly-traded companies making substantial investments into Bitcoin. This shift represents a significant marker of legitimacy for Bitcoin and is a major driver behind its recent price movements.

The rally began earlier this week when it was revealed that several large hedge funds had acquired substantial amounts of Bitcoin as a hedge against inflation. This news was quickly followed by announcements from several large multinational corporations that they had allocated portions of their cash reserves to Bitcoin, citing its potential for significant long-term returns.

Financial analysts are now closely watching the market, as the influx of big money could potentially lead to greater stability in the often volatile cryptocurrency markets. “The presence of large institutional investors can not only increase the financial base of Bitcoin but also contribute to its legitimacy and decrease volatility,” explained Jordan Higgs, a senior financial analyst at a leading investment firm.

The price of Bitcoin is not the only aspect of the cryptocurrency world that has seen a change. The increase in institutional investments has led to a surge in demand for crypto-related financial services, including custody and compliance solutions, as traditional financial institutions seek to bridge the gap between conventional financial systems and the growing crypto ecosystem.

Moreover, the technology behind cryptocurrencies, blockchain, is also experiencing a renaissance of sorts. Businesses across various sectors are exploring how blockchain technology can be applied to enhance transparency, security, and efficiency. This has led to an increase in venture capital flowing into blockchain startups, further spurring innovation and development within the sector.

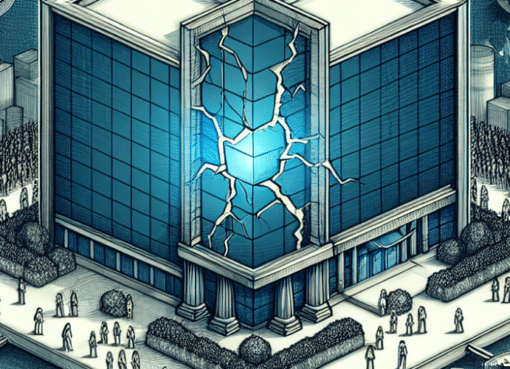

However, this bullish scenario is not devoid of caution. Critics and regulators are increasingly calling for stricter oversight of the cryptocurrency market. Concerns revolve around potential market manipulation, the inherent volatility of the market, and issues related to money laundering and other illicit activities.

Regulatory bodies in major economies around the world are already drafting guidelines and rules that could shape the future of cryptocurrency trading. The outcome of these regulatory moves could heavily influence the adoption and integration of cryptocurrencies into the mainstream financial system.

In addition to regulatory hurdles, the cryptocurrency market continues to be plagued by technical challenges, including scalability issues and the environmental impact of mining cryptocurrencies. These issues need to be addressed to ensure that Bitcoin and its peers can transition from niche investment options to mainstream financial instruments.

As Bitcoin continues its ascent, the broader implications for the global financial system remain uncertain. While some herald this moment as the dawn of a new era in finance, others caution against potential bubbles akin to the dot-com bubble of the late 1990s.

Regardless of one’s stance, it is undeniable that the landscape of investing and money management is evolving. Cryptocurrencies are at the forefront of this change, challenging traditional notions of currency and investment. As the lines between technology and finance continue to blur, the only certainty is that the journey ahead will be one to watch closely.

As we continue to monitor this evolving situation, the entry of institutional investors into the cryptocurrency market marks a potential turning point for Bitcoin and its peers. Whether this leads to a more stable and mature market or sets the stage for future turmoil remains to be seen. Investors and market watchers alike are advised to stay informed and tread cautiously as the cryptocurrency saga continues to unfold.