In an unprecedented leap in blockchain technology, recent developments within the decentralized finance sector have propelled DeFi to achieve a record-breaking total value locked (TVL) of $200 billion. This milestone marks a significant achievement in the ongoing evolution of blockchain applications beyond traditional uses, signaling a robust push towards greater financial inclusiveness and innovation.

The surge in DeFi’s popularity can be attributed to its revolutionary approach to financial services, offering an alternative to conventional banking and investment methods. DeFi platforms utilize smart contracts on blockchains, primarily Ethereum, to enable services such as lending, borrowing, and trading without traditional intermediaries like banks.

The Catalyst Behind This Record Growth

The latest spike in DeFi participation has been fueled by several key factors, one of which is the heightened interest in decentralized applications (dApps) from institutional investors. Large-scale backing from these institutional players has provided DeFi projects with not only financial leverage but also a higher degree of legitimacy and trust among broader user demographics.

Additionally, innovations in blockchain interoperability and the introduction of cross-chain technology have widened the scope for DeFi applications, allowing for more fluid and efficient interactions between different blockchain networks. This advancement has resolved one of the most significant barriers to blockchain adoption—limited scalability.

Impact on the Financial Ecosystem

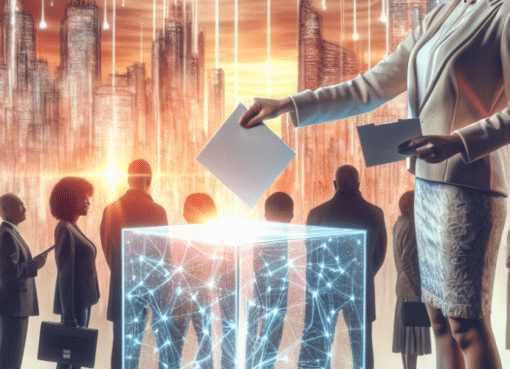

This remarkable growth in DeFi’s TVL reflects a broader shift in the financial landscape, where users are increasingly favoring transparent, secure, and inclusive financial mechanisms. DeFi platforms, by design, offer these features, promoting a more equitable financial system. Traditional financial institutions have taken note, with many exploring ways to integrate blockchain technology into their existing frameworks.

The impact of DeFi extends beyond just financial innovation. It is also catalyzing changes in financial policy and regulation. Governments and financial regulators worldwide are beginning to develop frameworks to accommodate these new technologies responsibly, aiming to curb the risks associated with digital assets while fostering innovation.

Future Prospects and Challenges

As DeFi continues to grow, experts anticipate further innovations, particularly in areas like risk management and synthetic assets. These innovations could address current limitations within DeFi, such as high volatility and the complexity of smart contract management.

However, this growth is not without its challenges. The scalability of blockchain networks, ensuring the security of smart contracts, and regulatory uncertainties remain significant hurdles. Additionally, the recent increase in cyber attacks on DeFi platforms highlights the ongoing need for enhanced security measures.

Conclusion

The record-breaking achievement in DeFi’s total value locked is more than just a milestone. It symbolizes the maturation of blockchain as a critical technology in shaping the future of finance. As DeFi platforms continue to evolve and address the existing challenges, the potential for blockchain to revolutionize the financial sector grows ever more promising.

This development is not just a testament to technological advancement but a beacon for future innovations that could redefine global financial systems. As blockchain continues to break down barriers, the full potential of DeFi remains vast and largely untapped, promising exciting possibilities for investors and financial professionals worldwide.